From Clicks to Bricks: Expanding Brand Loyalty through Physical Stores

by Declan McCormack, RDI

Introduction

It’s 2015. A new movement in retail is emerging where some direct-to-consumer brands (DTC) are dipping their toes in the pool of physical retail. Some industry voices are calling this new movement “Clicks to Bricks.” Shoppers wonder who these new brands are and why they should shop there versus the tried and tested brick and mortar stores they have shopped at for years. They question if this movement will succeed.

Fast forward five years. “Clicks to Bricks” (C2B) is now a household term. Dozens of brands have followed the lead of Bonobos and Warby Parker, et al. making the leap from entirely digital to adding physical and opening hundreds of stores along the way. This movement is disrupting retail, and it is here to stay.

The pioneers of the C2B movement have the benefit of experience in transforming from DTC models to successful online/offline retailers. Even so, they are still working on mastering physical retail and creating stores that deliver a brand experience that is equal to or better than their successful digital experience.

Now, the majority of later C2B adapters/followers are facing growing pains in translating their brands from a digital form to a physical environment. Because this movement brings an abundance of new brands to an already highly competitive and saturated marketplace, C2B retailers must get this recipe right. It is not just a matter of a simple translation tool, but rather understanding their new in-store consumers and creating a fresh way of shopping to meet their needs. Successful adaptation of a digital brand shopping experience to an in-store experience needs to incorporate knowledge of store shoppers’ behaviors and preferences. Not paying attention to this trend can mean the difference between success and failure.

Trends in the Retail Marketplace

To state the obvious, retail is in a state of transformation. Shoppers today have full control—dictating what they want, when they want it, how they get it and where. Today’s consumers, especially those from Generations Z and Alpha, are digital experts and gravitate toward online platforms where they can shop 24/7. These shoppers expect convenience and the ability to fulfill their shopping needs immediately. They want reassurance of shopping securely. Most importantly, shoppers need to trust the brands they support, necessitating brands to realize and meet their expectations. It is not business as usual anymore for retailers. In order to compete successfully and survive, retailers must listen to shoppers, understand their habits, uncover their unmet needs and find new ways to attract them.

DTC brands understand the importance of shoppers becoming comfortable with and ultimately loyal to their online brands. They are exceptionally good at collecting data about their online shoppers and shaping the digital buying experience to match their shoppers’ wishes and desires. Now, more DTC retailers are considering traditional retail models too. They recognize that amidst the continuing store closures and retail bankruptcies seen over the last several years, commercial real estate is more available and affordable, and the addition of physical retail stores can build brand awareness, grow their customer base and potentially increase online business. As such, many online-only retailers (“clicks”) are rewriting their business models and expanding into the physical retail space (“bricks”).

Several DTC brands have found success in the physical retail space, including Warby Parker, a company that sells prescription glasses and sunglasses, Fabletics, an activewear brand, and Bonobos, which sells menswear. To test their entrance into the retail space, Warby Parker started with pop-up shops, including using a transformed school bus as a rolling store. Eventually, the company opened its first retail store in Washington, D.C. in 2013 and now operates more than 100 brick and mortar stores in the United States and Canada. These stores now provide half of Warby Parker’s revenue.

Warby Parker, Cincinnati, OH

Similarly, Fabletics discovered the revenue advantages of opening physical stores after successfully building a loyal following online. As a result, the company has experienced an increase of two-and-a half times in revenue by opening brick and mortar stores and now has more than 40 retail stores in North America.

Bonobos – one of the first to enter the C2B market – started as an online brand exclusively in 2007 and distinguished themselves by offering a superior level of customer service. They began opening retail showrooms, called Guideshops, in 2012. The main focus of these Guideshops is to allow shoppers to try on the menswear. Sales “guides” (also known as “Ninjas”) assist shoppers throughout the in-store fitting process and then help them place online orders to be shipped to shoppers for free. The bonus for Bonobos is the in-store orders are twice the size of online orders.

Warby Parker continues to combine the best of their online and offline experiences to create a symbiotic relationship between them to satisfy their customers’ needs. One example of this is sales associates noticing shoppers coming into the stores with the names of the frames they wanted to try on written on pieces of paper. This led to Warby Parker updating their online shopping experience to allow shoppers to order their “favorite” frames online and then allow in-store sales representatives to access this information in the store. As well, shoppers who were not ready to make an in-store purchase can have their preferences saved to their online accounts by in-store sales representatives.

According to the commercial real estate firm JLL, DTC brands will open 850 stores in the next five years. Additionally, a survey conducted by the International Council of Shopping Centers found there is a 37% increase in overall traffic to a brand’s website after opening a retail store. It is crucial for the in-store experience to complement rather than compete with the online experience. However, many of these online-only retailers lack the resources and inhouse design bandwidth to create an unparalleled shopping experience for their shoppers who prefer to frequent a physical space. Many are relying on their online knowledge to create physical environments, which does not always translate into a rewarding experience for shoppers and a profitable venture for DTC brands. Online-only retailers need support to ensure the online experience shoppers are comfortable with smoothly translates to a similarly rewarding in-store experience, as most DTC brands do not have the creative bandwidth in store planning, design and experiential graphics.

While there is an abundance of articles and blogs written on the C2B movement, the majority were authored by marketing and business consultants and reference anecdotal evidence from the retailers rather than research directly garnered from shoppers. It is time to bring retail design thought leadership into creating a retail design experience that incorporates the most efficacious methods for translating a digital brand to a physical form that satisfies the needs of their shoppers.

Research Scope and Objectives

As part of BHDP’s commitment to excellence, the firm believes in using research, including data collection and analysis, to serve its retail clients and design retail stores that create positive consumer experiences. Due to the lack of available real data about consumers who shopped both on a brand’s digital online site and at its physical retail store, BHDP initiated research to learn more about shoppers’ online and retail store behaviors.

Glossier, Melrose Place, CA

BHDP crafted the research hypothesis, developed the questionnaire, and engaged Ask Your Target Market (AYTM), an independent, online market research firm, to gather input from 1,000 shoppers between February and March 2020. Respondents were from across the United States and not limited to major metropolitan areas. Information collected from respondents included age, education level, employment status, income level, relationship status, ethnicity/race, career and parental status. These shoppers were above the age of 18 and had previous or current experience shopping either online or in a retail store from a list of established C2B retail brands. These brands represented clothing, eyewear, cosmetics, jewelry and sleep product retailers that moved into the brick and mortar space within the last few years. The C2B brands included for this research were Adore Me, Alex and Ani, Allbirds, Athleta, Blue Nile, Bonobos, Casper, Everlane, Glossier, Indochino, Thirdlove, Untuckit, and Warby Parker.

Brands included in our research

The main objectives of this study included:

- Uncovering the influences and differences in shopper behaviors when shopping on a brand’s online site and at their brick and mortar retail stores.

- Understanding C2B shopper perceptions relative to the translation of a digitally native brand from online to offline.

- Identifying opportunities to enhance the in-store experience and better align it with the online brand experience.

Research Findings

The data from this research was analyzed by BHDP’s retail strategy and design group. It is unsurprising that the majority of shoppers who completed this questionnaire made their first purchase from the participating retailers via their online site. While one-half of these C2B shoppers prefer to shop online, it appears that many are embracing the C2B brand’s physical presence with 23% of them indicating they now prefer to shop in-store.

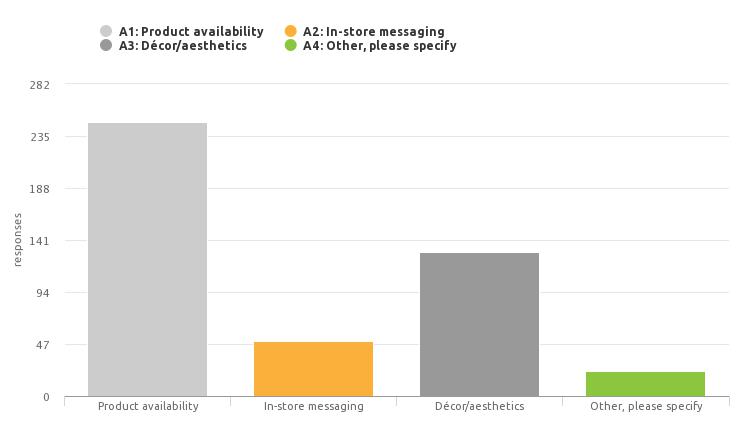

Q: In what ways did your in-store brand experience positively reflect the online brand experience? (Mark all that apply)

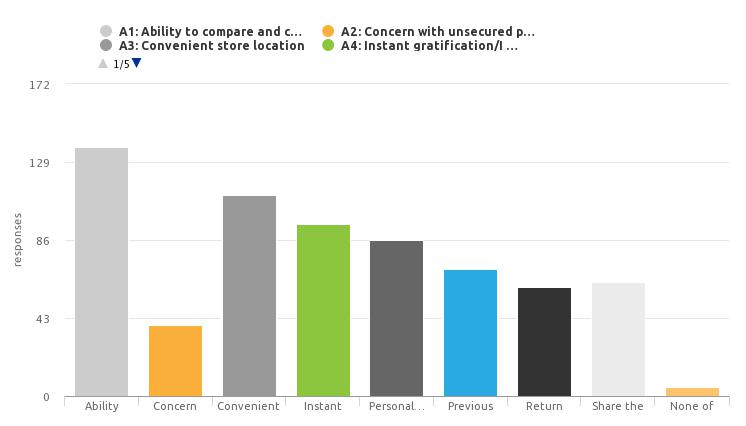

Of those shoppers who would rather shop in-store instead of online, 59% wanted the ability to compare and confirm specifics such as fit, color and texture, while 48% were influenced by convenient store locations and 41% liked the instant gratification of being able to leave with the purchased item. One shopper said, “They should have a wide variety of styles, colors and sizes,” while another stated, “I expect exclusive products, a wide selection of products, convenience and fair prices.” One shopper, who liked being able to shop and have the item the same day, said, “I also like seeing the textures and experiencing the vibe of the store.”

Q: Which reasons influence your preference to shop in-store from the retailer(s) you selected? (Mark all that apply)

On the other hand, shoppers preferring online shopping selected the no hassle appeal of virtual shopping (no crowds, parking issues or drive time) as their number one reason for using technology to shop. They also identified the lack of conveniently located stores as a negative for in-store shopping and cited the larger inventory of online platforms (compared to brick and mortar retail shops) and the ease of finding clearance or sale items as positives for online shopping. Overall, shoppers expect that items will be the same price and quality whether purchased online or in a retail store. They also expect the retail store to offer similar return policies and customer service as compared to the online site.

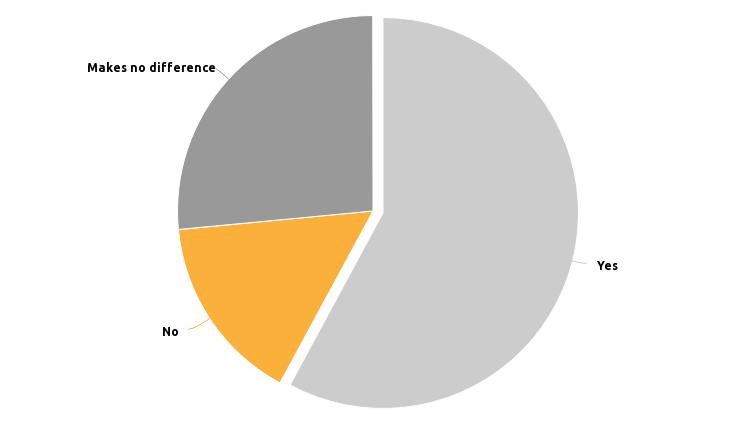

Q: Are you more likely to shop in a brick and mortar store rather than online if there is a brick and mortar store in your region?

While shoppers definitely have online shopping preferences, it is still important to understand why shoppers choose to visit a retail store after making an online purchase from the same brand. Fifty-seven percent of those surveyed shopped at the brand’s retail store after purchasing from their online site. The ability to try on the merchandise is a major influencer for shoppers visiting physical stores. Of those who chose to shop at a retail store after making an online purchase, 53% wanted to inspect the merchandise, while 37% had an interest in seeing how the in-store brand was expressed and 37% drove by the store. Shoppers expect the brand image to be carried over to the retail store and that the store feels like a full shop and not one that is quite empty or only carries limited products. One shopper stated, “It should be nice and resemble your online shopping experience,” while another said, “I expect there to be perks to encourage me to shop in-store instead of online, like helpful representatives and the ability to try on products.”

The C2B shopping experience also can influence shoppers to peruse the brand’s online site after making an in-store purchase. Of those surveyed, 68% shopped online after purchasing from a brand’s retail store. Many cited inconvenient store location (43%), low inventory or weak product assortment (32%) and limited store hours (29%) as reasons for shopping online. “It’s just that shopping online is more convenient,” said one shopper. Another stated that the retail store “didn’t have the item I was looking for,” and one shopper explained, “[I] was looking for a certain item and found it online instead.”

The research also collected information about how shoppers felt about both the in-store and online experiences. Almost three-quarters (69%) of shoppers who shopped at the brands’ retail stores after making an online purchase believed that the in-store brand matched the online brand. This was primarily due to product availability (63%) and the décor or aesthetics of the retail space (33%). “I expect the in-store aesthetic to be similar to the colors and design of the website,” said one shopper. Another shopper liked the in-store messaging and explained, “[The] mirror that said, ‘you look good’ emphasized values of brand in the store creatively, not limited to their online presence.” The majority of these shoppers (89%) were extremely or somewhat satisfied with their in-store experience compared to their online experience. “Found exactly what I was looking for, and if I couldn’t, staff was happy to help. Much like search bar online,” said one shopper. Less than 2% of shoppers were somewhat or extremely unsatisfied with their in-store experience. The vast majority of shoppers who had a negative in-store experience were disappointed in the brick and mortar store’s product availability. “A better variety of products online than in store,” said one shopper while another stated, “There has to be a big reason for me to go into the store.” Half of these C2B shoppers stated that access to in-store personalized customer service affects their decision to visit a brick and mortar store. Shoppers are fairly divided about how much personal attention they want from sales representatives when shopping in-store. Forty percent said it varies by what they’re purchasing, 36% want minimal attention and 23% preferred one-on-one customer service. However, 58% of shoppers said it is important to be able to order online from a sales representative while shopping in-store.

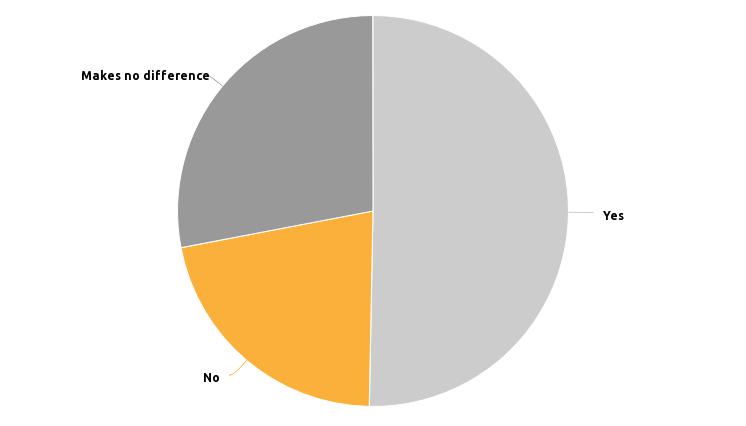

Q: Are you more likely to shop in a brick and mortar store rather than online if there is a brick and mortar store in your region?

Only 22% of online shoppers indicated they would not shop in-store if there was a retail store in their region, while 50% of online shoppers preferred to shop in-store and 28% said that it makes no difference. Travel time to a retail store impacts their decision whether to shop in-store or online, with 74% tolerating a 30 minute or less trip to the retail store.

Analysis of Findings

Despite the ease of purchasing online, many shoppers still want the option of visiting a brick and mortar location. In fact, shoppers are willing to travel a significant distance to enjoy the in-store experience. One significant factor for the in-store experience is being able to see and touch the merchandise as well as being able to take items home. One shopper stated in the survey, “I was able to see the quality of the merchandise. I was able to have a worry-free buying experience.”

The in-store experience provides the opportunity to build brand loyalty and shopper connection through engagement with real people. Ideally these people were trained to provide a more intimate and personal customer service experience as opposed to an impersonal online interaction. Comments from shoppers included they expected great customer service, employee recommendations and personal touches when shopping in the online brand’s retail stores. When shoppers were asked what their expectations were for brick and mortar stores originating from online only brands, the word “service” was used 157 times – one of the most frequently used words from respondents. The ability to order from the online site while in the physical retail store was important to 58% of respondents, reinforcing the preference for personal service and “virtual” immediate gratification.

Adore Me, Staten Island Mall, NY

However, shoppers are unhappy with the limited assortment of product in C2B stores. Many shoppers in this survey stated that the in-store experience did not match the online experience because the retail stores did not have the same product availability as online sites. Shoppers expect there to be as much or nearly as much product available in-store as there is online. “They sometimes don’t have my size in stock at the stores,” said one shopper.

This lack of product availability has significant ramifications on the design of C2B retail stores. The first impression is critical in retail. Because most C2B retail stores are smaller than traditional stores and unable to display the brand’s entire product line, it is important for store designers to impress shoppers quickly with an enhanced in-store experience. A worst-case scenario for retailers is when shoppers leave their stores disappointed or frustrated. In this case, it is unlikely the shopper will return to the store—another reason why an enhanced in-store experience is so important. It reassures shoppers that in-store experiences are worth the effort and strengthens the brand loyalty. Finally, many shoppers stated they shopped online after purchasing from the retail store, indicating that a positive in-store experience drives awareness and online business.

Recommendations

C2B retailers are seeking guidance in how to design a brick and mortal space that satisfies their shoppers’ needs without following the traditional retail store model. They also want to ensure survival in a competitive, saturated and constantly evolving retail landscape. Consider these recommendations as a roadmap for DTC brands moving to the C2B retail model:

- Listen to and understand what shoppers like and expect from the online experience.

- Develop solid strategies to design retail stores that ensure uniformity between the online and in-store experiences to reinforce their brand.

- Identify brick and mortar locations that meet the retailer’s specifications in areas where the target audience shops.

- Delight shoppers with their initial in-store experience.

Consistency is important. There should not be a disconnect between the online brand shoppers fall in love with and the C2B retail space. Instead, C2B retailers should create a seamless transition from online to in-store shopping by designing the physical space to reflect the feel of the online shopping experience. This is accomplished by C2B brands knowing their shoppers and recognizing their unmet needs and frustrations. One shopper, commenting on the décor and aesthetics of the retail store and how it positively reflected the online brand experience stated, “It felt like a candy shop, the feeling you get visually by looking at the website.”

Indochino, Seattle, WA

C2B shoppers want the opportunity to touch and feel the products and leave the store with product in hand or ordered with free shipping if the product is not available in-store. “There has to be a big reason for me to go into the store. Probably the ability to try things on in many sizes/styles and get customer service when needed,” stated one shopper. To strengthen the in-store experience, C2B retailers should consider offering:

- Professional and personal customer service and one-on-one consultative help.

- The ability for shoppers to order online while in the retail store.

- The ability to observe the entire product line via display technologies to compensate for smaller product assortments in-store.

Additionally, providing the convenience of in-store returns for online orders provides another touch point for retailers to make a positive impression and another opportunity for additional in-store purchases. When C2B retailers can translate the retail brand experience to align with their customers’ expectations, they can deliver more creative, innovative and engaging environments that build loyalty and generate increased revenue.

Conclusion

Amidst the continual store closures and retail bankruptcies seen over the last several years, DTC brands are opening physical stores at a substantial rate to build brand awareness and grow their customer base. However, they will be successful only by avoiding the mistakes made by traditional retailers. To survive and succeed in building market share in a highly competitive and saturated retail market, it’s essential for C2B retailers to:

Photo credit: Allbirds'Facebook account

- Understand the behaviors and beliefs of C2B shoppers before designing and building retail stores to meet the needs of these “click” shoppers.

- Sustain and even enrich the initial loyalty established during the digital shopping experience when designing the retail space.

- Leverage the in-depth knowledge of C2B shoppers’ behaviors, preferences and needs into store designs.

- Capture in-store information about shoppers, including where they are spending their time in the store and the movement of shoppers from one display to another and ultimately to the checkout area.

- Offer new technologies, such as kiosks to assist shoppers in ordering directly from the website if the desired product is not available in-store, and test-fit products like cosmetics with virtual capabilities.

- Compensate for limited SKUs with AR/VR technology, smart mirrors, etc.

C2B retailers are not looking to jump into the traditional retail model by offering everything found on their online site. Yet, shoppers want more than what is available at current C2B retail stores. This research demonstrates that C2B retailers still struggle to understand how their loyal online customers prefer to shop in a physical space. There are opportunities to dissect the research data presented here by a variety of demographics, including age, gender, education and income.

The ability to examine this data on a granular level for specific C2B retailers may yield additional information on how to best translate the online experience to an in-store experience and satisfy shoppers’ demands and desires.

Realistically, the transition from online to retails is not easy for “click” retailers. It starts with studying, researching, learning about and listening to their shoppers, then putting this knowledge into practice when designing the retail store experience. Understanding how C2B retail brands will grow in the future requires ongoing research, additional studies of consumer behavior, preferences and expectations and a deepening knowledge of trends in the industry. In this way, retail brands can develop a competitive advantage by opening brick and mortar stores that add to the value of an online brand and create an alternative to the traditional retail model.