The Evolution of Bank Branch Design

Early Branch Design

It’s worth noting how bank branch design has evolved over the years. Decades ago, banks were the city’s centerpiece; solid stone facades designed intentionally to instill a sense of security, stability, and longevity. Beautiful, but no doubt, costly endeavors. Over time, bank branch design evolved to a more cost-effective and repeatable rollout model—it had to.

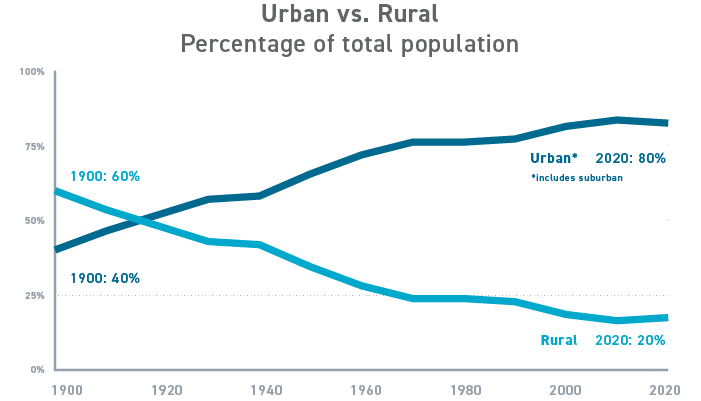

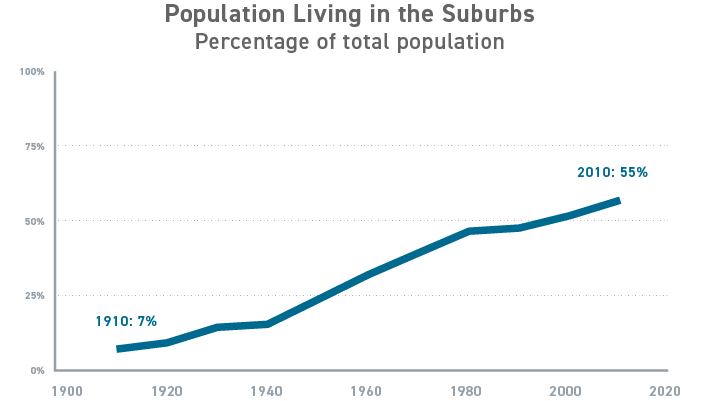

Two notable points in US history forced this shift, the first being the end of World War II. The post-war boom began the population shift from dense urban living to suburban community life (See US Census Bureau data below). Then came the Federal Aid Highway Act of 1956, which also drove a massive population migration to the suburbs. Less than five years later, there were as many people living in the suburbs as urban residents (57:43 urban-to-suburban population ratio at the time of WW2).

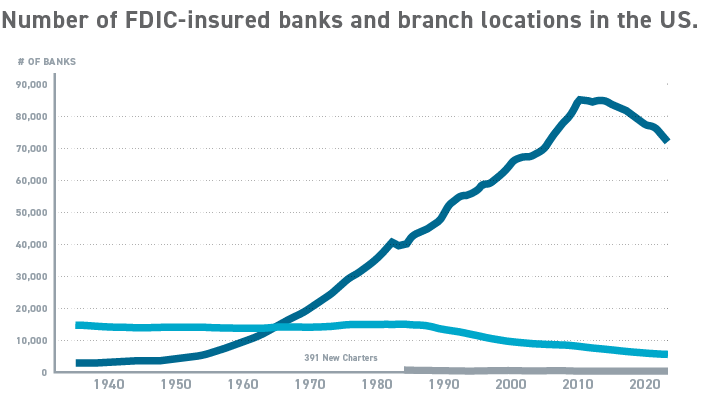

To reach their migrated customer base, banks had to extend their footprints beyond the traditional urban branch location model. The graph below (data from the FDIC) displays how, in the late 1950s, the bank branch curve took on a whole new trajectory, and the bank branch development explosion began. In 1960, there were approximately 13,000 bank branches in the entire United States. Since then, that number has increased more than sixfold to today’s approximately 72,000+ branches. The late 1980s began a time of consolidation in the industry, with the total number of banking organizations beginning the decline from around 14,000 in 1983 to just under 4,300 today. That acquisition (Charter) model became the common means for larger banks to continue to grow and spread their footprint.

Banking Today

Today’s aesthetic is dramatically different from branches of yesteryear. Terrazzo floors, marble counters, wood-paneled walls, and muted colors have been replaced with more inviting environments—softer materials, finishes, and furnishings, creating less intimidating and more welcoming spaces. Solid stone facades have been replaced by glass storefronts. Another major component of branch design today is the integration of experiential graphics within the environment, creating opportunities to communicate with customers visually and allowing them to learn about financial products and services independently.

Visuals, technology, and graphic communications pique the browsing mindset of a retail shopper within a store. This mindset overlays perfectly with branch shopping, potentially filling waiting time with the opportunity to self-educate. BHDP’s retail research shows that most retail shoppers prefer to browse alone before engaging with an associate. The retail branch of today isn’t always set up to accommodate this preference.

Staffing models and styles have also changed over the years, and a more relaxed style has replaced the once-formal environment. The dreaded teller line barrier has been broken down, to some degree, by creating other options for customers and associates to engage, such as more casual seating environments and, in some cases, in-branch cafes.

While the retail banking experience has shown incremental changes over the decades, the challenges we face now are the age of branch inventory and limitations on available capital spend. Even if 10% of the 72,000+ United States branch inventory were upgraded yearly, every branch would only be touched in 10-year increments—twice as long as the typical retail refresh model of 5 years. Many existing bank branches there haven’t been refurbished in years, even decades.

The Growing Role of Technology

As previously mentioned, the buzz today in bank branch design is the integration of new technologies; namely ITMs and Virtual Tellers. Many financial institutions are exploring smaller footprints, with fewer physical tellers and more technology. While this is a natural progression due to major advancements in technology, it’s not a “one size fits all.” We need to be careful not to lose the personal connection between the customer and bank associate; after all, most customers visit branches today because they have a need for one-one advice, such as loans, mortgages, investments, and other services that are best handled in person.

The human connection is as important as ever for these types of services, and we need to be mindful of still providing that opportunity for customers. As this enhanced tech model evolves, we will learn more about how customers are adapting to a new style of banking. But, for now, we cannot lose sight of the benefits of customers visiting branches—the connection with their local bank associate, the place to engage with their bank of choice, the opportunity to self-educate, and, most importantly, the feeling of a good one-on-one service experience that creates a good memory and encourages a future in-branch visit.

The Future of Branch Design

Do we really understand the mindset of the branch customer as it pertains to their expectations around the in-branch environment experience? Do we understand the correlation between aged branch environments and customer satisfaction, retention, and recurring in-branch visits? As an industry, do we need to reevaluate capital spending strategies? Instead of allocating 90% of available capital to 10% of the fleet, is there a way to spread the spending across a more significant percentage of the fleet and reduce the refresh frequency?

Our retail research has taught us that providing environmental refreshes at a closer cadence excites shoppers and gives them something new to embrace. Even in retail, not all upgrades are equal, but retailers are savvy about their shoppers and have succeeded in spending wisely. Today, there is less focus on flagship spend and more on applying available spending to a more significant proportion of the fleet in a tiered investment manner dependent on location, shopper data, and demographics. There are lessons to be learned from the retail refresh model.

How can we equalize the fleet or at least get closer to having more branches use a modern setup to deliver an improved in-branch customer experience? The banking industry’s BAU refresh approach is a good start, but we are still coming up short year on end. Could there be a “BAU Lite”—small spend, more locations, positive impact—focused on heightening the senses of branch customers?

BHDP’s sensorial shopper research shows that the human senses can significantly define our subconscious experience and create lasting positive or negative memories. Many learnings from the study can be translated directly to retail banking, and we intend to uncover just where these connections lie. As we strive to understand the people for whom we design, we plan to delve deeper into the needs and motivations of banking customers. Stay tuned for further insights.

If you're looking to discuss your bank design needs, reach out to Declan McCormack at [email protected] or 513.527.0206.

Author

Content Type

Date

July 13, 2023