Strategic Mergers and Acquisitions in Higher Education: A White Paper for Institutional Leaders

Read the full white paper below, or download a PDF copy.

Executive Summary

As higher education institutions face mounting demographic, financial, and competitive pressures, there are increasing demands for accountability and return on investment (ROI). Mergers and Acquisitions (M&A) are now seen as a strategic option for colleges and universities as they seek viable paths forward for sustainability and mission advancement. Once considered taboo, M&A discussions are becoming normalized as institutional leaders seek to align resources, enhance academic offerings, and ensure long-term viability.

In June 2025, BHDP Architecture, a leader in the higher education industry, facilitated a virtual roundtable with industry leaders that contributed their insights and perspectives to the M&A discussion. The participants were:

- Dr. Cheryl McConnell | President, Saint Joseph’s University

- Dr. Lance Richey | President, University of Saint Francis

- Dr. Marcheta Evans | President, Saint Catherine University

- Dr. Jennifer Kostic | Senior VP of Administration, Sinclair College

- Dr. Jamie Caridi | President/Founder, Terra Firma Consulting Services, LLC

- Paul Orban | Managing Principal, BHDP Architecture

- Tom Sens | Client Leader, BHDP Architecture

- Bob DeColfmacker | Senior Consultant, Stevens Strategy

Their collective insights underscored the importance of regulatory planning, transparent communication, mission and cultural alignment, and strategic planning during an M&A.

To complement these insights, in July 2025, BHDP surveyed 36 College and University Presidents, Chief Financial Officers (CFOs), and Chief Academic Officers (CAOs) on their perspectives regarding M&As. The 2025 survey of higher education leaders revealed a sector facing sustained financial pressures, growing interest in strategic partnerships, and increasing willingness to consider M&As as a path toward sustainability. These presidents, CFOs, and CAOs provided insights into enrollment trends, financial realities, motivations, and barriers related to M&A. 58% of the respondents relayed that they have formally discussed M&A in the past two years. Supporting the idea that M&A is no longer a fringe consideration, 52% of the respondents have already identified potential partners for exploration, engaging in discussions, and scouting opportunities.

Together, the survey results and roundtable perspectives provide institutional leaders with research-backed framework for approaching M&A not only as a financial strategy, but also as a pathway to long-term sustainability and mission fulfillment. This white paper distills those insights into actionable strategies and lessons learned to guide leaders considering M&A as part of their institutional future.

Introduction: Defining Mergers and Acquisitions

Once a controversial topic, the discussions of mergers and acquisitions have become popular amongst postsecondary executive leadership teams and boards that are looking for strategic mission fulfillment and long-term sustainability and viability. In higher education, a merger and acquisition refers to the process where two or more institutions combine their operations, assets, and sometimes their student populations for sustainability. The difference between a merger and an acquisition is primarily about structure, control, and perception. A merger is when the two institutions combine to form a new entity. This is where leadership, governance, and assets are typically integrated, and both institutions may have input into the new structure. This process can be presented as a strategic partnership to ease the perception by the institutional communities, whereas the institutions are equally blending to create something new.

Roundtable participants emphasized that terminology matters. During the roundtable discussion, one participant noted that while the term “merger” is often used for comfort, true mergers are rare in higher education. An acquisition is where one institution takes over another. In this scenario, the acquiring institution takes the lead and retains its identity, leadership, and governance, while the acquired institution is absorbed and its programs, assets, and sometimes staff are integrated into the acquirer, losing its name and independent operations. Another participant stated that due to the confusion and sensitivity that can surround the terminology, her institution had to shift the language to more accurately reflect the reality of the transactions. “We used to say mergers. We now use the term acquisition.” By understanding these foundational concepts, leaders can approach M&A with clarity.

However, by combining both qualitative insights from peer experiences of the roundtable and quantitative evidence from the recent survey findings, there is an emphasis that higher education mergers and acquisitions are fundamentally different from the corporate world. The transition for the universities and colleges involved is a deeply human process, requiring sensitivity to institutional identity, stakeholder concerns, and the regulatory environment. The stakes are very high because successful mergers and acquisitions can secure a legacy and expand opportunity, while missteps can erode trust and destabilize communities. Higher education leaders are encouraged to seek expert guidance to help navigate the challenging waters and guide strategic decision-making.

Key Themes from the Roundtable and 2025 Survey

As the roundtable participants engaged in a robust discussion around the complexities of mergers and acquisitions (M&A) within higher education, central themes emerged—including the importance of mission alignment, cultural compatibility, and navigating regulatory frameworks. Participants repeatedly emphasized the value of clear communication, transparency, and strategic planning as essential ingredients for success. The 2025 survey of higher education leaders revealed a sector facing sustained financial pressures, growing interest in strategic partnerships, and increasing willingness to consider M&A as a path toward sustainability. These presidents, CFOs, and CAOs provided insights into enrollment trends, financial realities, motivations, and barriers related to M&A, which supported many of the themes of the roundtable discussion.

Motivations for M&A

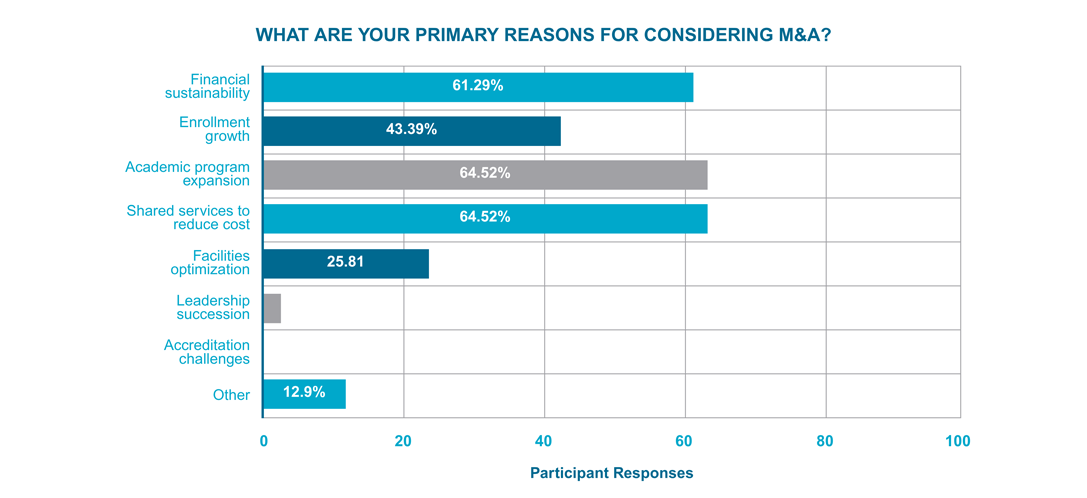

According to the survey responses, there are several top drivers for institutional leaders to consider M&A. The breakdown of the top drivers is as follows: Academic program expansion (65%), Shared services and cost reduction (65%), Financial sustainability (61%), and Enrollment growth (48%). The implication is that leaders see M&A primarily as a growth and sustainability strategy, rather than simply a response to crisis. Many of these motivators were integrated within the themes discussed during the roundtable discussion as well.

Mission & Culture Alignment

Mission and cultural compatibility are foundational for M&A success. In addition, the compatibility of values, identity, and purpose is non-negotiable when initiating the search for potential partners for the M&A. Survey respondents and roundtable participants alike emphasized that a lack of alignment can lead to failed integrations, resistance, or even the collapse of the deal. In addition, both the tangible (programs, accreditation) and intangible (values, community, leadership style) aspects of mission and culture must be considered and communicated throughout the process.

One leader shared that her university’s acquisitions were driven by a strategic need to add academic programs and serve new student populations, which required mission alignment. She noted that cultural fit is essential, especially when integrating programs and faculty from different institutions. She discussed the need to be clear about what will change and what will remain the same to manage expectations and cultural transition.

Another president emphasized that mission and culture alignment were central to her public, transparent approach to seeking a partner. She highlighted the importance of finding a partner with shared values, especially as a minority-serving institution, and stressed that cultural fit and leadership willingness are as important as financial or academic considerations.

Another president involved in the M&A of a not-for profit, faith-based institution integrating with a for-profit institution discussed the challenges involved with these two very different types of institutions. He noted the importance of communicating mission alignment to both internal and external stakeholders, including religious sponsors. He highlighted that both sides must bring something meaningful to the table and that the merger should be mutually beneficial in terms of mission and culture.

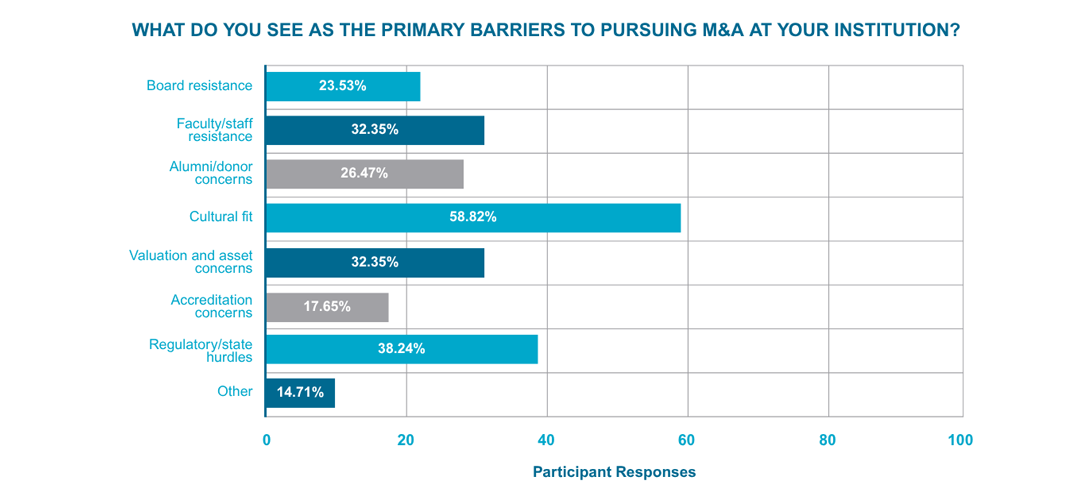

The survey supported this notion as the theme of cultural fit was the most cited barrier (59%) to pursuing M&A, underscoring the critical role of mission alignment in successful M&A outcomes.

Regulatory Navigation

Navigating the regulatory landscape emerged as a central challenge in higher education mergers and acquisitions, as emphasized by several roundtable participants and survey participants. Accreditation and state approvals require early, strategic engagement. Bob DeColfmacker of Stevens Strategy, LLC, highlighted the significant compliance complexities institutions face, noting that accreditation and regulatory hurdles can vary widely depending on the type of accreditor and Department of Education requirements.

Jamie Caridi of Terra Firma emphasized that the Department of Education’s regulatory approval process for mergers and acquisitions has become increasingly longer and more complex than in the past, which can create additional challenges and delays for institutions seeking to complete M&A transactions.

A president candidly shared his own experience underestimating the duration and intricacy of accreditation reviews, both with their regional accreditor and state board, and stressed the importance of setting realistic expectations for a process that can easily span a year or more. As another president reinforced the need for proactive planning, she reminded leaders that multiple regulatory bodies, including attorney generals and the NCAA, may be involved and that waiting too long to engage these entities can jeopardize institutional viability.

In light of the layered regulatory and accreditation barriers, another participant pointed out that the acquisition of established programs often represents a more practical and efficient strategy than initiating new ones. Collectively, the speakers underscored that early, expert engagement with regulatory agencies and a clear-eyed approach to compliance are essential for successful M&A outcomes in higher education. Regulatory hurdles were cited by 38% of survey respondents as a barrier, corroborating roundtable insights on the importance of early, expert regulatory engagement.

Transparent Communication

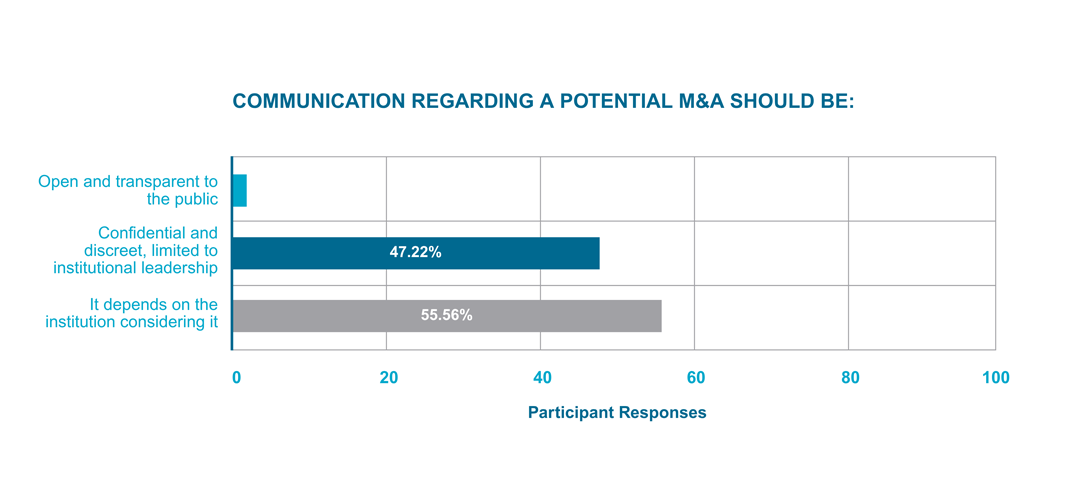

During the roundtable discussion, there was a diversity of opinions by participants on the topic of communication and the importance of timing and transparency. Some participants felt passionate about clear and transparent communication from the start, whereas others felt that early communication was premature and really needed to wait until there was evidence of viability to protect all constituencies.

One participant said that her experience led her to believe that early and public communication was vital as an institution considers M&A. “It needs to be much sooner, even when you start looking for potential partners. While you are developing a committee or task force to address it, your community is already going to know what you are doing and why you are doing that.” This participant's perspective was that early, consistent messaging builds trust across stakeholders. In addition, she noted that their institution’s communication was public from the start, which helped with meaningful community involvement and transparency through the process.

Another participant had a different experience and recommended focusing on “why” the institution is wanting to acquire, why they are looking for a strategic partner, and what the long-term goal is. She stated, “It’s always phrased in those terms, ‘we're seeking a strategic partner’ because that sounds a lot safer than ‘we're seeking to be acquired’, because your community doesn't like to hear that. They like to hear that you're searching for a strategic partner, and in their minds, it's often somebody that's going to come in and let you do what you're doing and save you, and everything will be fine. It's kind of like a savior complex.” The participant also relayed the challenges the institution had in maintaining the secrecy and confidentiality of the potential partnership and the community’s reaction when the news went public. The conversation underscored the necessity of a comprehensive approach to communication, involving a complex organization of boards, leadership, and stakeholders, all of whom play a critical role in ensuring a successful integration of the merger or acquisition. It was concluded that communication strategies will vary depending upon the institution and case at hand.

The survey responses reflected the diverse communication approaches discussed in the roundtable as nearly half (47.22%) of the survey respondents favored confidential and discreet early-stage discussions limited to institutional leadership, while less than 3% advocated for open transparency to the public. 56% of the respondents said it depends on the institution considering it.

Programmatic Advantage

One of the observations that emerged from both the roundtable and survey was that there is a keen advantage for an institution to acquire strong, accredited programs, especially in high-demand or regulated and competitive fields like health sciences, game design, technology, etc. Whereas buying programs with existing accreditation can be faster and more effective than building new ones, building new programs from scratch would be difficult, slow, or impossible due to regulatory and accreditation hurdles. Mergers and acquisitions can provide immediate access to new student populations and markets.

One president gave the example during the roundtable that the biggest attraction they had in a partner school they were looking to merge with was that they had an LPN program, which is in very high demand, and they had an unlimited enrollment cap if the clinicals could be provided. “If we start our own program, we'll be capped at 50 students for five years, by which time the market will have passed us by.” Another president referenced that her college had one of the top game design programs, and a potential partner sought interest in them due to their simulation and animation labs.

In support of this roundtable insight, survey respondents identified academic program expansion as a top motivation (65%) for pursuing M&A, confirming the strategic advantage highlighted by roundtable participants.

Community Engagement

Roundtable participants emphasized that strong partnerships and honoring legacy identities are essential for securing buy-in during mergers and acquisitions. Community engagement was viewed as critical for transparency, building support, and ensuring successful transitions. Leaders highlighted the importance of timely and open communication with both internal and external stakeholders, including local partners, alumni, and the broader public. Participants agreed that engaging the community early and transparently—rather than delaying communication—helps mitigate risks associated with secrecy and fosters long-term institutional support.

Governance Coordination

The roundtable participants emphasized that effective governance coordination is fundamental to the success of higher education M&A’s. They noted that early and ongoing education of boards and leadership teams is essential for a unified vision and to prevent misunderstandings and ensure alignment throughout the process. Forming dedicated committees comprising of board members, senior administrators, and legal counsel was recommended to focus on the unique complexities of M&A transactions. The discussion highlighted that governance is rarely straightforward, especially when multiple boards, external sponsors, or religious orders are involved, often requiring careful negotiation and clear communication to align interests and decision-making authority. Participants also pointed out that emotional and cultural integration at the governance level is as important as operational coordination, with the need to respect institutional histories and leadership dynamics. Overall, the group agreed that proactive, transparent, and inclusive governance structures are critical for navigating the challenges and achieving successful outcomes.

In addition, 42% of survey respondents reported that their boards had M&A committees, indicating a significant opportunity for leadership development and structured governance.

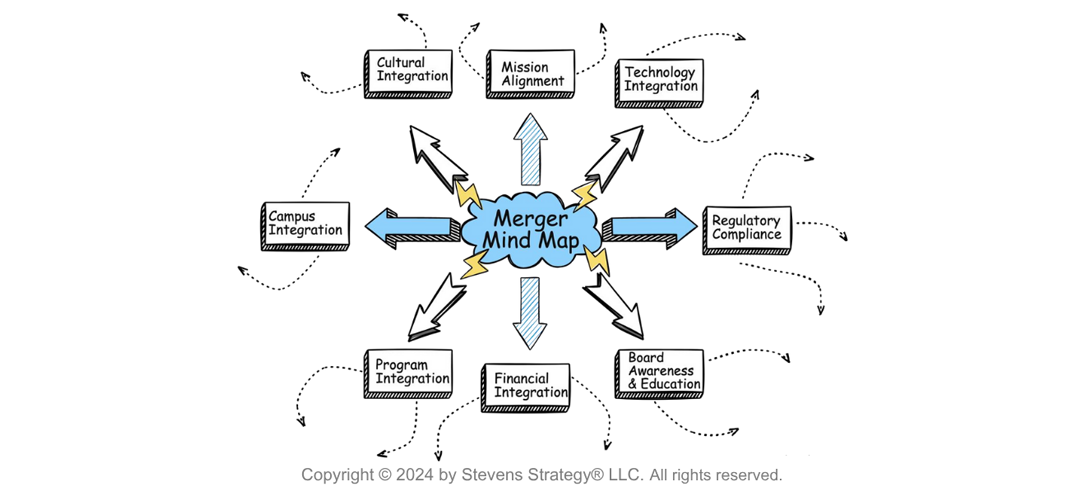

Bob DeColfmacher introduced the concept of the “Merger Mind Map” by Stevens Strategy, LLC, drawing on his experience as Board Chairman at Southern New Hampshire University and Senior Consultant for Stevens Strategy, LLC, where he has advised on various institutional mergers and acquisitions. He devised the concept of the “Merger Mind Map” to guide boards, presidents, and management teams through the due diligence phase of M&A.

Bob introduced “mission alignment” as the first and most critical element in his Merger Mind Map. He emphasized that mergers should only proceed if there is strong mission alignment, cultural fit, and integration; sometimes a merger is a way to intentionally change or expand the mission (e.g., acquiring new program fields). Technology integration is essential and can be expensive as well. If not careful with regulatory compliance, many issues can arise through the process.

Board education and awareness are also important. Bob emphasized the need for coordination and alignment among key personnel in the areas of finance, campus operations, and academics as the institutions undergo the integration process. The map acts as a framework for discussion for all entities and individuals involved in the M&A.

Framework for Successful M&A: The Five-Stage Process

During the roundtable discussion, Dr. Jamie Caridi, President of Terra Firma Consulting, LLC, a higher education consulting firm that works with boards and institutional leaders on alternative futures, presented an engaging, structured five-stage M&A process. This process is intended to help boards and leadership teams evaluate and approach M&A opportunities thoughtfully and strategically.

Stage 1: Discovery

In this first stage, Jamie describes the process as a discrete, behind-the-scenes process, where he advises that the board primarily establishes an Ad Hoc Committee or an Alternative Futures Committee. The committee should not be exclusive to board members; it should include the President, the Chief Academic Officer, the Chief Financial Officer, and the college’s general counsel.

During this stage, an institution must take inventory of its institutional assets before going out and asking who might want to become an academic partner. These assets are a variety of things and can be tangible or intangible. What specific value assets do you, as an institution, bring to the table?

Tangible institutional assets include land, physical facilities (campus buildings and grounds), and geographic location, while intangible assets include brand equity, accreditation, intellectual property, the institution’s athletic conference, institutional relationships, and human and operational capital. Stage 1 truly is a discovery process, as leaders often don’t have a comprehensive view of their strategic assets when they begin this exercise.

Jamie stated, “You need to take inventory of your assets, because typically, a school that wants to merge has its challenges, and Bob's already mentioned a scenario where it is never good for two struggling institutions to merge. So, you really need to understand what you bring to the table, and then that alternative futures committee, the board, with some management team members, needs to determine quickly what its non-negotiables are, so that when you begin to engage the broader community, you know what's on the table and what's not on the table. Of course, the more that falls into the non-negotiable category, the smaller population set that is going to be interested in you. So, you want to be careful with that.”

This is also the stage where realistic timelines and milestones are set, a brief Institutional Prospectus is developed stating its value proposition, and a Request for Inquiry (RFI) is created to help identify a partner. Each school approaches this list differently. Some schools will look within their state, while others will look at their mission. As Jamie noted, “If you're a Christian-affiliated institution of a particular denomination, you might be including all of those schools. So, there are different ways to put together that list, but it's usually not an inconsequential list. Schools that have done this well have created lists of 50, 60, 70, plus institutions to engage for prospective partnership.” Unless two institutions come together on their own through an existing relationship and pre-existing knowledge of each other’s desires, an institution seeking an M&A partner has no choice but to be vulnerable at the end of this phase in revealing that it is seeking a strategic partner. They do this by sharing their RFI and prospectus with their previously developed list of prospective partners.

Stage 2: Due Diligence

Due diligence requires a broader task force, including expanding key stakeholders’ engagement to be materially involved. Obviously, an awareness of a potential M&A becomes more widely known. While some risk is inherent at this stage, involving experts to analyze financial health, academic offerings, regulatory requirements, and cultural compatibility is necessary to address these critical issues. In this stage, it is also pertinent to involve legal, academic, and real estate experts for a comprehensive evaluation.

Stage 3: Negotiation

Once a solid partner is identified through the due diligence process, the focus shifts to negotiating terms. Items pertinent to this stage in the process are Letters of Intent, defining governance and structure, and aligning various board approvals on both sides. Beginning to initiate work with the regulatory bodies for the approval process is also part of this stage.

Stage 4: Final Agreements and Approvals

This is the stage where all the approvals of all the accrediting bodies are secured. This is the opportunity to launch a strong and engaging communications plan, which is essential to emphasize transparency and stakeholder engagement.

Stage 5: Transition and Integration

To ensure the last stage of the process goes well, the institutions must define date-defined deliverables and success metrics, monitor KPI’s, and manage the cultural integration. Finally, support of leadership and community adaptation is essential for a smooth transition.

Application of this process by engaged institutions and/or organizations going through a merger and acquisition has shown to create a smooth transition for all.

Property and Facility Acquisition

During the roundtable, Paul Orban, Higher Education Market Leader at BHDP Architecture, led a discussion regarding facility and property acquisition during an M&A. This discussion helped elicit detailed responses from the participants about the complexities and lessons learned in acquiring physical assets during mergers and acquisitions.

A participant emphasized the necessity of clearly defining the nature of a merger or acquisition at the outset. In her institution’s case, the transaction centered on the acquisition of academic programs rather than physical assets, making it strategically prudent to exclude property costs given elevated real estate values. She contrasted this with another case in which two institutions pursued a real estate-driven transaction: one institution assumed operational responsibilities while the other closed its campus but retained its name.

Another participant relayed that her institution underwent some real estate transactions during their M&A process. She noted that their president was in favor of acquiring more real estate and felt it was a benefit to their university. This senior leader is currently working on a thorough master plan that will take into consideration what the campus of the future will look like and the challenges of transforming physical space to accommodate the present and future student population. “As I'm looking at my enrollment, I am now looking at a trend that is 50-52% FTE face-to-face, and 48% online, and we are also facing that demographic cliff that every one of you is looking at as well. That tells me that we are not going to have huge enrollment spikes in the next 5- 10 years of people coming to campus, so I don't have dorms, but I have 20 buildings that have thousands of square feet… how do I make that space usable space and continue to modernize that for the campus of the future? That is a challenge.” Thankfully, she reiterated that they have a very supportive board that is helping to find solutions and supporting them through the process.

Other recommendations were made by the participants to conduct thorough facilities assessments while going through the due diligence process of the M&A. Several noted the concern of inheriting deferred maintenance or unusable space and for institutions to use expert facilities teams to evaluate and assess the condition, suitability, and long-term costs of any property being acquired. BHDP is frequently engaged by these colleges to conduct these assessments and audits.

In addition, one participant emphasized that institutional leaders should plan for flexibility and future use of properties and be open to repurposing, leasing, or divesting facilities that no longer align with institutional needs. Factoring in the potential for future changes in student demand and program delivery can help with campus facilities restructuring as part of the master planning process.

Institutional mergers and acquisitions also allow the opportunity for leaders to engage in strategic master planning, whereas facilities decisions are integrated into the institution’s strategic plan.

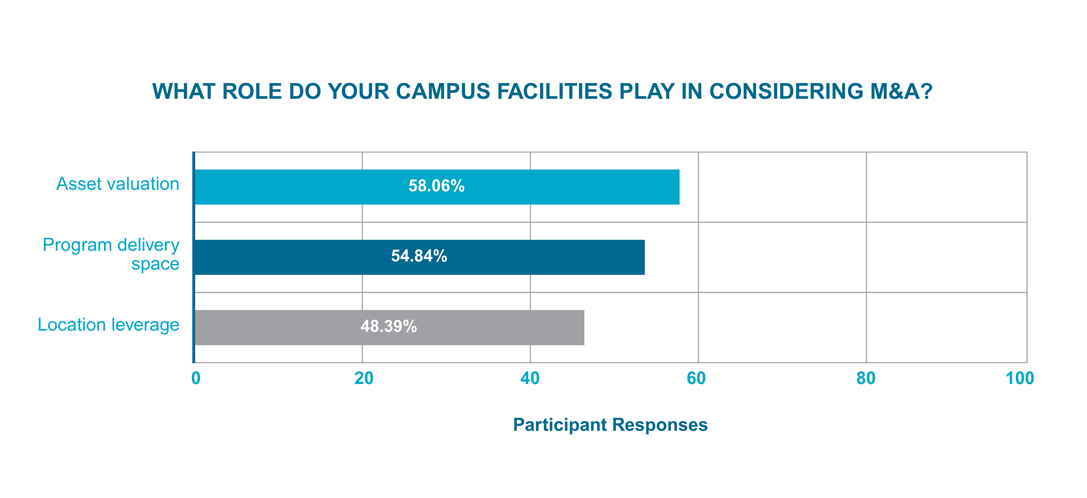

Both roundtable participants and survey responses agree that by integrating facilities decisions into broader institutional strategy and master planning, institutions can ensure that physical assets support long-term goals, upholding the mission and vision of the university. When the survey participants were asked what role their campus facilities played in considering an M&A, 58% of the responses said asset valuation was the main role. Roundtable participants recommended that institutions approach facilities acquisition with strategic clarity, rigorous assessment, and flexibility, ensuring that physical assets truly support academic and financial sustainability rather than becoming burdensome liabilities.

Lessons Learned from Mistakes Made in Higher Education Mergers and Acquisitions:

The roundtable’s collective experience shows that successful M&A requires early regulatory engagement, transparent communication, stakeholder involvement, careful cultural integration, and a clear-eyed assessment of both financial and physical assets. Survey findings corroborate these lessons, citing cultural fit, regulatory hurdles, and faculty/staff resistance as the top barriers, emphasizing that these mistakes are common across institutions. Avoiding these common mistakes can help institutions achieve smoother transitions and more sustainable outcomes.

Start Regulatory and Accreditation Processes Early

The roundtable participants emphasized that underestimating the time and complexity of regulatory approvals can derail timelines. One president recommended beginning engagement with accreditors, state agencies, and the Department of Education as soon as possible. He emphasized that this regulatory and accreditation process could take at least a year. In concurrence, 38% of the 2025 survey participants also relayed that regulatory hurdles created challenges for their institutions.

Prioritize Clear, Early, and Transparent Communication

Lack of early and honest communication with stakeholders (faculty, staff, students, alumni, and community) can breed mistrust, resistance, and confusion. Two participants noted that in their experience, unclear messaging set unrealistic expectations, and one president emphasized the need for transparency from the outset. Although another president stressed that early confidentiality was important when conveying public communication, all participants agreed that balancing confidentiality with timely, transparent communication must be thoughtfully considered by each institution for each of its constituencies throughout the process.

Engage Stakeholders and Leadership Early

Early inclusion of key leaders, board members, and stakeholders is essential to ensure governance, financial, and community perspectives are integrated into decision-making. Roundtable participants cautioned that delayed engagement often limits buy-in and creates avoidable challenges. One president reflected that earlier involvement of his board chair and senior cabinet members would have surfaced critical insights and significantly streamlined the process. 32% of the survey participants underscored this by noting faculty and staff resistance created a sizeable challenge for their institution.

Don’t Let Confirmation Bias Rush the Process

Entering M&A discussions with preconceived notions or rushing due diligence can lead to poor decisions and failed integrations. As Bob DeColfmacher discussed his experience, he described how confirmation bias and lack of board education led to a failed merger.

Address Cultural Integration Directly

An important lesson was failing to plan for and manage cultural differences between institutions. This was exemplified by two leaders who shared their experience where a lack of planning can undermine integration and long-term success. They both highlighted the importance of addressing culture and having clear messaging about what will change that will be given to the institutional community. To support this notion, 59% of the survey participants cited cultural fit to be the top challenge an institution faces during an M&A.

Be Transparent About Financial Realities

Concealing or sugarcoating financial challenges can erode trust and hinder problem-solving. One participant reiterated, “Don’t wait until it’s too late.” She shared that opening financial books to faculty can build credibility and understanding. Executive teams need to make these decisions and have these conversations before operating cash is diminished.

Distinguish Between Real Estate and Program Value

Acquiring property without a clear plan for its use can create long-term liabilities. 32% of survey participants said that valuation and asset concerns were among the top barriers and risks they faced. To help minimize the risk, two roundtable leaders discussed the importance of distinguishing between real estate and academic program acquisitions and the value each will bring to the strategic partnership.

Conclusion

In today’s rapidly evolving higher education landscape, mission-aligned mergers and acquisitions offer a strategic pathway to long-term resilience and relevance. As institutions confront mounting financial pressures, shifting demographics, and increasing regulatory complexity, M&A’s, when approached with clarity and purpose, can serve as a powerful tool for transformation. Insights from the BHDP Higher Education M&A Virtual Roundtable and the 2025 M&A Survey of Higher Education Leaders underscore that successful outcomes demand more than financial expertise. Cultural alignment, strategic vision, and disciplined execution are essential for a smooth transition during an M&A.

Transparent communication, stakeholder engagement, and rigorous due diligence must anchor the process from the beginning. Institutional leaders need to recognize M&A’s as a human-centered endeavor, one that requires navigating identity, legacy, and the expectations of diverse constituencies. Assembling the right leadership team, establishing strong governance, and engaging external expertise are critical to managing accreditation, compliance, and integration effectively.

Call to Action

The merger of physical space and assets requires proper due diligence and strategic foresight to create a space strategy supportive of academic and student life initiatives and to optimize the institution’s operating capital. Land and buildings must be viewed as strategic assets, whether they support the institution moving forward in their current state, by being repurposed, or as potential assets to be monetized. Ultimately, the campus spaces must support the institution’s strategic plan and fit well within the financial plan moving forward.

For institutions seeking guidance on navigating M&A's while optimizing campus assets, BHDP Architecture provides expertise in strategic and integrated campus master planning, academic programming advising, and facility assessments. Their experience ensures that physical assets, academic programs, and infrastructure are aligned with long-term strategic goals, supporting smooth transitions and sustainable growth.

Author